You already know life costs are rising, and saving alone isn’t going to cut it.

What you earn today won’t hold the same value 5, 10 or 20 years from now. That means every day you delay investing is a day you lose on financial security, on freedom, on the life you deserve.

Whether you’re in your 20s, 30s, 40s or beyond, now is the moment to act. Because the earlier you start building wealth, the bigger your advantage.

6 powerful reasons to begin investing today

Inflation eats away your savings

With cost‑of‑living pressures always growing, what your retirement fund or savings are worth now may not cover the comforts you expect in the future. Smart investing keeps your wealth ahead of inflation.

The power of compounding

When you invest well, you will receive returns not only the original amount you invested but on-top of the returns your dollars earn as you go. Essentially, returns on your returns, which snowballs (or compounds) the longer you keep that investment. The longer you’re investing for, the larger the compounding effect. Property prices double every seven to 10 years, so being in it for the long haul is where you are going to get the most impact.

Earning potential limits

The majority of Australians are employed for the standard 5 days/ week, at 7.5 hours/ day. This limits your ability to earn past that limit, and there are only so many contributions you can make towards your super and retirement without taking away from your current quality of life.

Tax benefits that boost your returns

With property investment, you may be eligible for deductions (from mortgage interest to depreciation and maintenance) giving your long-term returns a real boost.

Increasing retirement age

Recently, the age of retirement increased to 67 years. Many people see this as an incredibly long time to wait before clocking out of the workforce and making the most of the next chapter (especially when the life expectancy is 83!). If you want to retire sooner, you’re going to need to fatten up the bottom line via other means.

Because everyone else is

According to Finder.com, 51% of Australians hold investments, with Millennials being the most likely generation to hold an investment at 61%. If your peers, family and friends are investing now and you are not, they will be living a very different life to you post-career.

Build the life you want

A steady, passive income stream — Rental returns that help grow wealth without needing 9‑5 hours.

Real, tangible assets under your name — Property is physical, stable, and less fickle than many other investments.

A safety net for retirement or life’s curveballs — With sound investing, you’re building a nest egg that can support you through retirement, support family goals, or even fund dreams like travel, starting a business or early retirement.

Every year you wait:

you lose the power of compounding,

lose out on modest gains stacking up into serious equity,

risk being further behind when you finally want to retire, slow down or shift paths.

But when you take the first step today — with a plan, expert guidance, and a clear strategy — you begin building momentum. That momentum turns into real results: stability, freedom, and real choices.

Can I afford to invest in property?

Locale’s Property Investment Strategists know a thing or two about finding ways for their clients into the investment market. It may seem daunting and you may have inbuilt beliefs that you cannot afford to make this kind of financial strategy part of your portfolio. However, investing in property, in Western Australia is not as overwhelming as you think.

One of the biggest barriers people face when it comes to property investment is the belief that they need significant savings to get started. This can feel like a major roadblock, especially if you’re busy managing everyday expenses or other financial commitments. But there’s good news: you may already have what you need to invest.

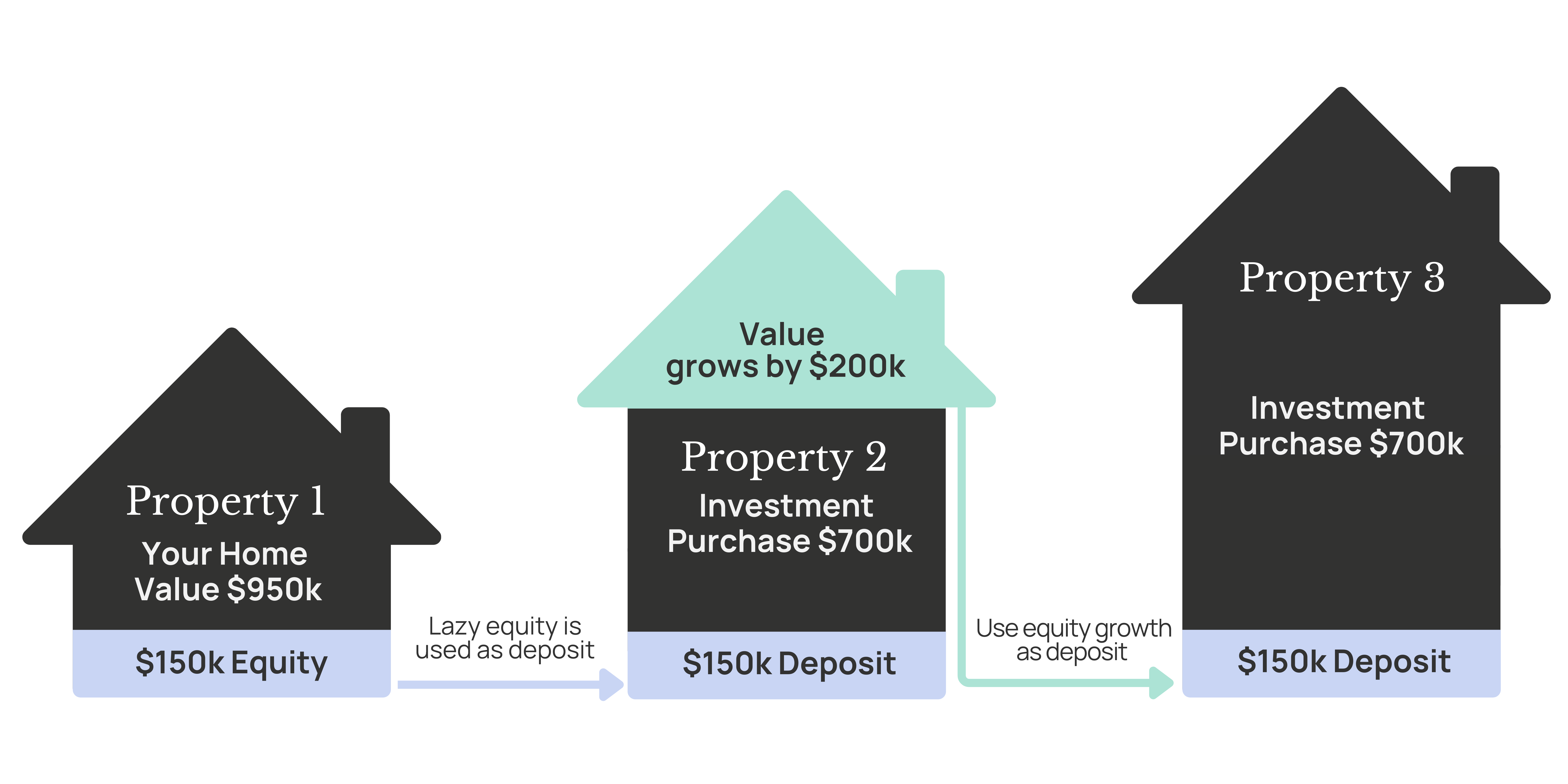

Lazy Equity

This is the available and untapped potential in your existing home — the difference between your property’s current market value and what you owe on it. You can use this equity as the deposit for your investment property without having to come up with any additional funds.

If you have paid down your current mortgage and/or your home’s value has increased since you last financed the mortgage, you will have built up equity.

Bigger borrowing power

When the bank or lender evaluates how much you can borrow for an investment property, they have different considerations to an owner-occupier loan. With an investment property, they are expecting a rental income to comprise some or most of the repayments (and in this current economy, rental income is high) rather than simply the income from your salary or wage. So the borrowing power for your investment property is typically higher, giving you more options to purchase a strategic property.

Can I afford to invest in property?

Let’s see how much you can borrow.

Chat with one of our in-house finance experts to find out how much you can borrow and invest.

Get started with some FAQs

Indicators of a successful property investment include strong rental income, consistent property value appreciation, low vacancy rates, reduction of tax commitments, and meeting or exceeding your investment goals. Achieving these signs contributes to your overall financial security and can help you move closer to financial freedom.

We don’t charge any upfront fees to clients at Locale Wealth. We get paid a commission on the property you purchase as an investment, similar to how a mortgage broker gets paid.

We have the largest selection of properties available, based on our many years of experience and deep connections to Australia’s largest property developer and builders. We remove the sales consultant from the process, we deal direct with the developers, leveraging our MD’s many years of experience leading a major property and construction group.

Unlike many investment companies that simply deal with a sales consultant at the developer/builder, we avoid the double fees many people pay by going through third-party channels.

At all times, we work in your best interests and have access to stock before it becomes public, giving you a leg up when securing property.

Our mission is to inspire and educate people so if that is all we do while you might go away and think and take some time to get your finances in a place where you feel ready to go ahead, we have done our job.

By making this session you are taking the first steps to financial freedom. All you will need to do is answer some questions which our team will talk you through. Our approach is to understand your needs and aspirations.

Before we meet, we do suggest thinking about the following questions: What are your financial goals? How much do you have in savings? When would you like to retire? Do you know your borrowing capacity? (it’s ok if you don’t know, we can help).

Common strategies include leveraging property to maximise returns, diversifying your investment portfolio, and implementing tax-efficient practices. We will consider strategies like negative gearing and positive cash flow management if they work for you.

While yes, there is a financial component to being able to invest, the bigger factor is your mindset. Do you want to take some time out of your busy life to sit and think about what you want your future to look like, and create a plan to get there? Or, are you going to continue on with your day-to-day life and expect that your retirement plans and savings are going to sort themselves out?

Waiting for the perfect time is not the answer. The best time to invest is now.

Are you ready to see what your financial potential is and build a life that you really want?

To measure the success of your property investment, evaluate your investment portfolio by assessing rental yield, capital growth, and overall return on investment (ROI). Regularly review your financial goals to ensure they align with your progress toward financial freedom and financial security.

To scale your property investment portfolio, consider reinvesting profits into additional properties, exploring different property types, or expanding into new markets. Continuously review your strategy and adapt based on performance and market conditions to ensure you are progressing toward your financial goals and enhancing your financial security.